February 2024 MLS REPORT

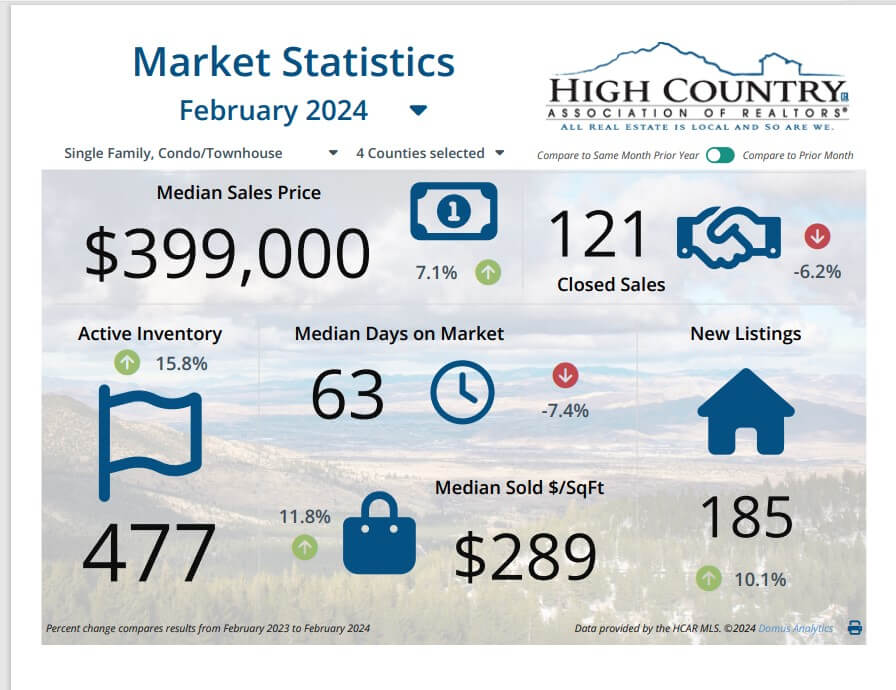

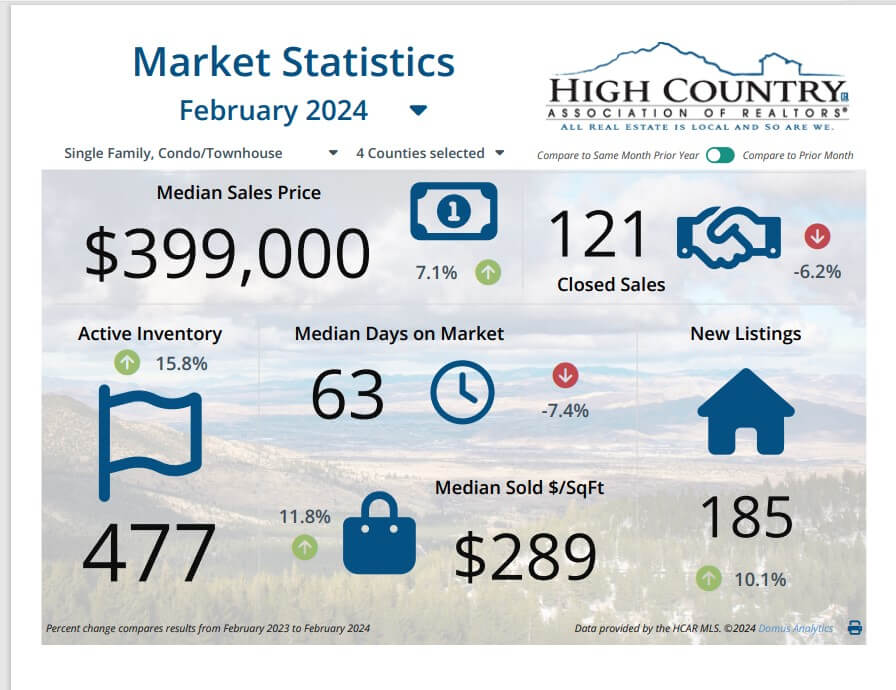

REALTORS® in the High Country Association Jurisdiction of Alleghany, Ashe, Avery, and Watauga Counties are anticipating a busy spring. During February, there were 121 residential properties that sold for a combined total of $80.7 million for the month. The combined median sales price for the counties for the month was $399,000.00 The median days on the market were 63 days.

Nationally: According to a recent report from the National Association of Realtors®: "While home sales remain sizably lower than a couple of years ago, January's monthly gain is the start of more supply and demand," said NAR Chief Economist Lawrence Yun. "Listings were modestly higher, and home buyers are taking advantage of lower mortgage rates compared to late last year."

INVENTORY: High Country MLS is reporting an increase in their monthly supply of inventory for residential properties. February reported 185 in new residential listings and a total of 474 in active residential listings, equating to a 3.9 months’ supply of these properties in Alleghany, Ashe, Avery, and Watauga Counties up 22.7% from this same time a year ago.

LAND: Land sales are up as there is a plenteous supply of land in the High Country. During February, there were seventy-seven closed land sales in the high country area for a combined total of $8.1 million for the month. Currently there are 1,448 active land inventories equating to that plenteous 18.8 months’ supply of inventory for land in the high country.

COMMERCIAL: Currently reported to the High Country Multiple Listing Service there are fifty-six active or under contract commercial properties in Alleghany, Ashe, Avery, and Watauga Counties. There was one commercial sale reported to the MLS in February totaling $600,000.

Alleghany County: Realtors® closed on twelve residential properties in February for a combined total of $3.78 million in sales in the month. The median sales price was $300,000 and median days on market were 105 days. There were thirteen land sales closed in February for a combined total of $1.4 million and a median sales price coming in at $55,000.00.

Ashe County: Realtors® closed on twenty-five residential properties in February for a combined total of $12.84 million for the month. The median sales price came in at $399,000 and the median days on the market was 92 days. There were twenty-three land sales closing for a combined total of $2million for the month. The median sales price was $49,900.00

Avery County: Realtors® closed on twenty-six residential properties during February for a combined total of $27.13 million for the month. That median sales price comes in at $316,500 and the median days on the market at sixty-three days. The county had twelve land sales closing in February totaling $1.3 million for the month. The median sales price comes in at $75,225.00.

Watauga County: Realtors® closed on fifty-eight residential properties for a combined total of $37 million for the month of February. The median sales price was $450,000.00 and the median days on the market were forty-one days. There were twenty-nine land sales closing for a total of $3.28 million for the month. The median sales price came in at $95,000.00 for the month.

Interest Rates: Jeff Reeves of Fairway Mortgage recently stated, “Interest rates have moderated somewhat from their 2023 highs, but remain elevated compared to recent years, impacting the mortgage market. This shift influences buyer affordability and the overall pace of the housing market. Some market researchers suggest the potential for further moderation in rates during 2024. Potential homebuyers should carefully assess their financing options and consult with a mortgage professional to understand how current rates may affect their purchasing power.”

Disclaimer: Figures are based on information from High Country Multiple Listing Service. Data is for informational purposes only and may not be completely accurate due to MLS reporting processes. This data reflects a specific point in time and cannot be used in perpetuity due to the fluctuating nature of markets.

Report graphics generated from Domus Analytics pulled from the HCAR Web API feed. HCAR Realtor® members can access these detailed and customizable reports and graphics for professional use by logging into the HCAR dashboard - Info Hub. A public graphic is available on our website homepage at highcountryrealtors.org.